Almost half of the U.S. population lives paycheck to paycheck and/or does not have enough money in savings to cover an unexpected expense of $500 or more. That can be even more worrisome especially during our current global health pandemic. Many Americans are having to rely on stimulus or unemployment from the government that will eventually run out and normal living expenses may become overwhelming.

Here are our best tips on how to budget for unexpected expenses, live events, or emergencies, so you can worry less and be prepared for anything that may arise.

Lower Your Housing Costs

For those that may not be able to afford the normal month to month living expenses, or for those having to move due to any unforeseen circumstance, InTown Suites Extended Stay Hotel is an option to consider.

InTown Suites offers low and affordable monthly rates that more often than not will save you more than traditional apartment rentals. There are also no credit checks, no monthly agreements, or leases when it comes to your extended stay at Intown. What’s even better? Your amenities (like premium TV) and utilities are all included in your low monthly rate so you can remove those particular line items from your monthly budget.

More importantly, InTown Suites offer flexible payment options to put you at ease. You can easily renew your room for another day, week, or month with your debit or credit card using the secured online payment system. If you need to leave town for any reason, you also have a Stow & Go Rate which allows you to hold your room (with all your belongings) at a low nightly rate.

Budgeting 101

When it comes to budgeting for unexpected expenses, you have to actually have a budget, to begin with; and not just have a budget, but actually follow a budget.

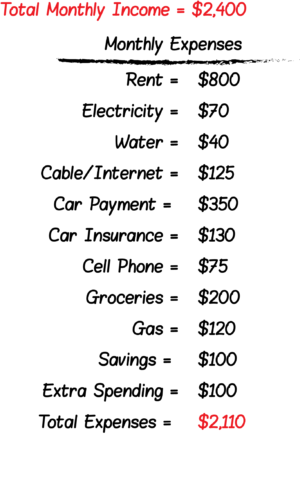

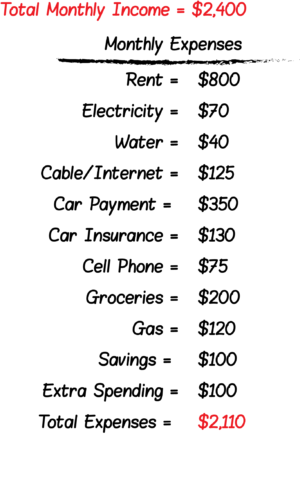

To create your budget you will want to write down how much money you bring home (after taxes) in a month, this is your TOTAL MONTHLY INCOME. Next, make a list of all recurring MONTHLY EXPENSES and their cost. It should look something like this:

You’re probably thinking, based on this I should have $290 leftover each month –where is all my money going. This is the following the budget part we mentioned above. For the next week or two, start keeping track of all your spending, even if it’s $1 here or $0.50 there, it all adds up!

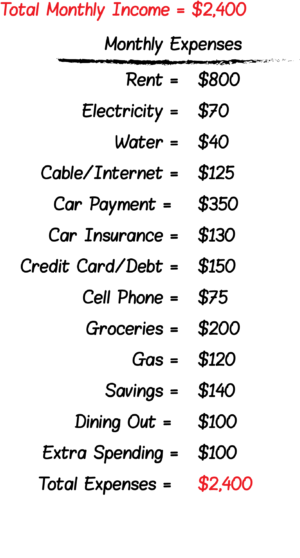

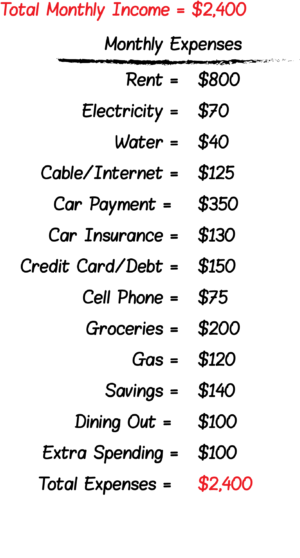

Once you have accounted for all your spending, make adjustments to the budget you made above. You may have forgotten a credit card you need to pay monthly, your weekly dinner out at a restaurant, etc.

Any “extra” money you have leftover at the end of each month should go towards your savings. The goal is to get your TOTAL EXPENSES to equal your TOTAL MONTHLY INCOME and leave you with a zero balance each month.

You’re updated budget may look something like this:

Pay in Cash

A great tip for following and sticking to your budget so that you can pay for unexpected expenses when they pop up –is to pay everything in cash. Yes, that’s right, cold hard cash!

Buy a box of business envelopes ($1 at any dollar store) and label each envelope with a MONTHLY EXPENSE. While this may seem monotonous, we promise it will pay off big!

At the beginning of each pay period, head to the bank or ATM and take out the cash you will need for the month sans your savings (but you have to promise not to dip into it.) Then when each bill is due, use the allotted cash from your envelope.

For example, if you go to the grocery store at the beginning of the month and spend $150 on groceries, that means you only have $50 left (in cash) for groceries for the rest of the month.

Once your cash is gone from your envelope, it’s gone, so spend wisely.

Build Your Emergency Fund

Now here’s what you’ve been preparing for –building an Emergency Fund so you have a surplus for unexpected expenses!

Get To $1,000 As Quick As You Can

First thing is first, you want to put $1,000 into your savings account (i.e. EMERGENCY FUND) as quickly as you can. But remember, don’t touch this account. It’s strictly for unexpected expenses and emergencies only!

Get creative. Do you have gently used toys or electronics you could sell? Maybe you have a unique skill like drawing dogs and you could sell pet portraits. Like we said, get creative!

Here’s a list of ways to get your $1,000 together quickly:

- Mow lawns

- Babysit

- Walk dogs

- Cash in your change jar

- Work overtime

- Freelance

- Drive for Uber or Lyft

- Deliver for Grub Hub, Postmates, Door Dash

- Deliver Pizza

- List items for sale on Facebook Marketplace

Once you have your $1,000, your next step is to contribute to your savings as much as possible each month. This way you build a pool of emergency money when real emergencies come up.

Bonus

If you nail following your budget and your first $1,000, your next goal is to save 3 months worth of expense and add it to your savings account. Why? If you should lose your job because of any unforeseen circumstance, you’ll be prepared with 3 months of expenses saved and not having to scramble to figure out how to pay your bills.

Almost half of the U.S. population lives paycheck to paycheck and/or does not have enough money in savings to cover an unexpected expense of $500 or more. That can be even more worrisome especially during our current global health pandemic. Many Americans are having to rely on stimulus or unemployment from the government that will eventually run out and normal living expenses may become overwhelming.

Here are our best tips on how to budget for unexpected expenses, live events, or emergencies, so you can worry less and be prepared for anything that may arise.

Lower Your Housing Costs

For those that may not be able to afford the normal month to month living expenses, or for those having to move due to any unforeseen circumstance, InTown Suites Extended Stay Hotel is an option to consider.

InTown Suites offers low and affordable monthly rates that more often than not will save you more than traditional apartment rentals. There are also no credit checks, no monthly agreements, or leases when it comes to your extended stay at Intown. What's even better? Your amenities (like premium TV) and utilities are all included in your low monthly rate so you can remove those particular line items from your monthly budget.

More importantly, InTown Suites offer flexible payment options to put you at ease. You can easily renew your room for another day, week, or month with your debit or credit card using the secured online payment system. If you need to leave town for any reason, you also have a

Stow & Go Rate which allows you to hold your room (with all your belongings) at a low nightly rate.

Budgeting 101

When it comes to budgeting for unexpected expenses, you have to actually have a budget, to begin with; and not just have a budget, but actually follow a budget.

To create your budget you will want to write down how much money you bring home (after taxes) in a month, this is your TOTAL MONTHLY INCOME. Next, make a list of all recurring MONTHLY EXPENSES and their cost. It should look something like this:

You’re probably thinking, based on this I should have $290 leftover each month –where is all my money going. This is the following the budget part we mentioned above. For the next week or two, start keeping track of all your spending, even if it’s $1 here or $0.50 there, it all adds up!

Once you have accounted for all your spending, make adjustments to the budget you made above. You may have forgotten a credit card you need to pay monthly, your weekly dinner out at a restaurant, etc.

Any “extra” money you have leftover at the end of each month should go towards your savings. The goal is to get your TOTAL EXPENSES to equal your TOTAL MONTHLY INCOME and leave you with a zero balance each month.

You’re updated budget may look something like this:

You’re probably thinking, based on this I should have $290 leftover each month –where is all my money going. This is the following the budget part we mentioned above. For the next week or two, start keeping track of all your spending, even if it’s $1 here or $0.50 there, it all adds up!

Once you have accounted for all your spending, make adjustments to the budget you made above. You may have forgotten a credit card you need to pay monthly, your weekly dinner out at a restaurant, etc.

Any “extra” money you have leftover at the end of each month should go towards your savings. The goal is to get your TOTAL EXPENSES to equal your TOTAL MONTHLY INCOME and leave you with a zero balance each month.

You’re updated budget may look something like this:

Pay in Cash

A great tip for following and sticking to your budget so that you can pay for unexpected expenses when they pop up –is to pay everything in cash. Yes, that’s right, cold hard cash!

Buy a box of business envelopes ($1 at any dollar store) and label each envelope with a MONTHLY EXPENSE. While this may seem monotonous, we promise it will pay off big!

At the beginning of each pay period, head to the bank or ATM and take out the cash you will need for the month sans your savings (but you have to promise not to dip into it.) Then when each bill is due, use the allotted cash from your envelope.

For example, if you go to the grocery store at the beginning of the month and spend $150 on groceries, that means you only have $50 left (in cash) for groceries for the rest of the month.

Once your cash is gone from your envelope, it’s gone, so spend wisely.

Build Your Emergency Fund

Now here’s what you’ve been preparing for –building an Emergency Fund so you have a surplus for unexpected expenses!

Get To $1,000 As Quick As You Can

First thing is first, you want to put $1,000 into your savings account (i.e. EMERGENCY FUND) as quickly as you can. But remember, don’t touch this account. It’s strictly for unexpected expenses and emergencies only!

Get creative. Do you have gently used toys or electronics you could sell? Maybe you have a unique skill like drawing dogs and you could sell pet portraits. Like we said, get creative!

Here’s a list of ways to get your $1,000 together quickly:

- Mow lawns

- Babysit

- Walk dogs

- Cash in your change jar

- Work overtime

- Freelance

- Drive for Uber or Lyft

- Deliver for Grub Hub, Postmates, Door Dash

- Deliver Pizza

- List items for sale on Facebook Marketplace

Once you have your $1,000, your next step is to contribute to your savings as much as possible each month. This way you build a pool of emergency money when real emergencies come up.

Bonus

If you nail following your budget and your first $1,000, your next goal is to save 3 months worth of expense and add it to your savings account. Why? If you should lose your job because of any unforeseen circumstance, you’ll be prepared with 3 months of expenses saved and not having to scramble to figure out how to pay your bills.